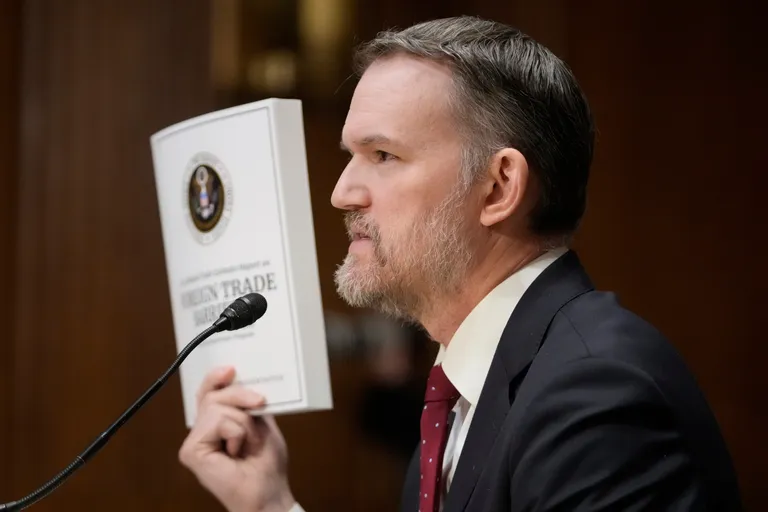

Washington, D.C. – The potential for increased U.S. trade tariffs looms as deadlines for negotiations approach. Treasury Secretary Scott Bessent recently emphasized the necessity for trading partners to negotiate “in good faith” to avoid the re-imposition of higher tariff rates.

A temporary reduction to a 10% baseline, implemented on April 2nd, is set to expire for countries that have not reached agreements. President Trump has indicated that tariffs will “ratchet back up” in the absence of concluded deals.

Negotiation Focus Areas

The United States is actively engaged in efforts to finalize agreements with 18 key trading partners. Secretary Bessent also raised the possibility of pursuing regional trade agreements, which could streamline tariff structures for groups of nations. While specific timelines for rate adjustments were not detailed, the urgency of the negotiation period was underscored.

Developments Regarding China

Recent progress has been noted in trade relations with China. Following discussions in Geneva, a temporary de-escalation occurred. The U.S. significantly reduced tariffs on Chinese imports from 145% to 30%, while China lowered duties on U.S. goods from 125% to 10%.

This development was positively received by financial markets, contributing to gains such as a more than 5% rise in the S&P 500 index during the week of the announcement, illustrating market sensitivity to trade policy news.

Administration’s Approach

Addressing market volatility attributed to fluctuating tariff policies, Secretary Bessent characterized the administration’s strategy as “strategic uncertainty.” This approach is intended to prevent trading partners from gaining an advantage in negotiations by keeping U.S. positions less predictable. The stated objective is that this tactic will ultimately benefit domestic retailers, consumers, and workers.

Domestic Economic Implications

The impact of fluctuating tariffs on domestic businesses, particularly small enterprises reliant on imported goods, remains a significant consideration. Increased costs incurred by companies are frequently passed on to consumers, effectively acting as an indirect cost burden.

Large retailers, including Walmart, have publicly expressed concerns regarding potential price increases. This led to a notable public exchange where President Trump suggested they “eat the tariffs.” Secretary Bessent confirmed that while Walmart would absorb some costs, consumers could anticipate some price adjustments.

National Debt Rating Update

In a separate but related economic development, Moody’s Ratings recently downgraded the U.S. government’s debt rating from its highest level, AAA, to Aa1. Moody’s cited the rising national debt, which has reached approximately $36 trillion, and ongoing legislative impasses regarding fiscal policy as primary factors for the downgrade.

Significance of the Downgrade

Despite Treasury Secretary Bessent’s efforts to minimize the significance of the Moody’s downgrade, such ratings hold influence in financial markets. They inform investor perceptions of the risk associated with lending to the U.S. government.

A perceived increase in risk can lead investors to demand higher interest rates on U.S. Treasury securities. Elevated U.S. Treasury yields can have broad economic repercussions, affecting borrowing costs for mortgages, corporate loans, and potentially influencing global interest rates. Understanding these interconnected elements is crucial for comprehending the broader economic landscape.

Contact us today through our website or WhatsApp to discover how we can help you achieve success in the United States. Together, we can turn dreams into reality.

Information source: edition.cnn.com