In the high-stakes world of AI technology, even giants can get caught in geopolitical crosswinds. Nvidia, the powerhouse behind the chips that make our modern digital magic happen, just announced they’re facing a $5.5 billion hit this quarter due to new U.S. restrictions on exporting their H20 AI chips to China.

The Silicon Valley Speedbump

The news sent ripples through Wall Street on Wednesday, with Nvidia shares dropping 7% and erasing nearly $200 billion in market value faster than you can say “semiconductor.”

That’s not just pocket change – even for a company that brought in a whopping $39 billion in the fourth quarter alone. The restrictions represent what Bank of America analyst Vivek Arya calls an “up to 10% earnings headwind” for the company this year.

A Manageable Challenge

Despite the eye-popping numbers, analysts aren’t hitting the panic button just yet. Bernstein analyst Stacy Rasgon noted this setback is “not enormous in the grand scheme of things,” considering China accounted for just 13% of Nvidia revenue last year – the lowest proportion in more than a decade.

The Broader Market Impact

Nvidia wasn’t the only tech company feeling the pinch. The restrictions created a domino effect across the semiconductor industry, with Intel and TSMC shares falling 3%, while Advanced Micro Devices (AMD) tumbled 6% after making similar disclosures about losses related to Chinese export curbs.

The broader markets took notice too – the S&P 500 and Nasdaq dipped 1.2% and 1.9% respectively, reminding us that in today’s interconnected economy, what affects tech titans often ripples throughout the entire market.

The Potential Silver Lining

According to UBS analyst Timothy Arcuri, there may be a silver lining to this cloud. The restrictions could potentially represent a “concession” from Nvidia that might encourage the White House to ease off on other AI regulatory frameworks.

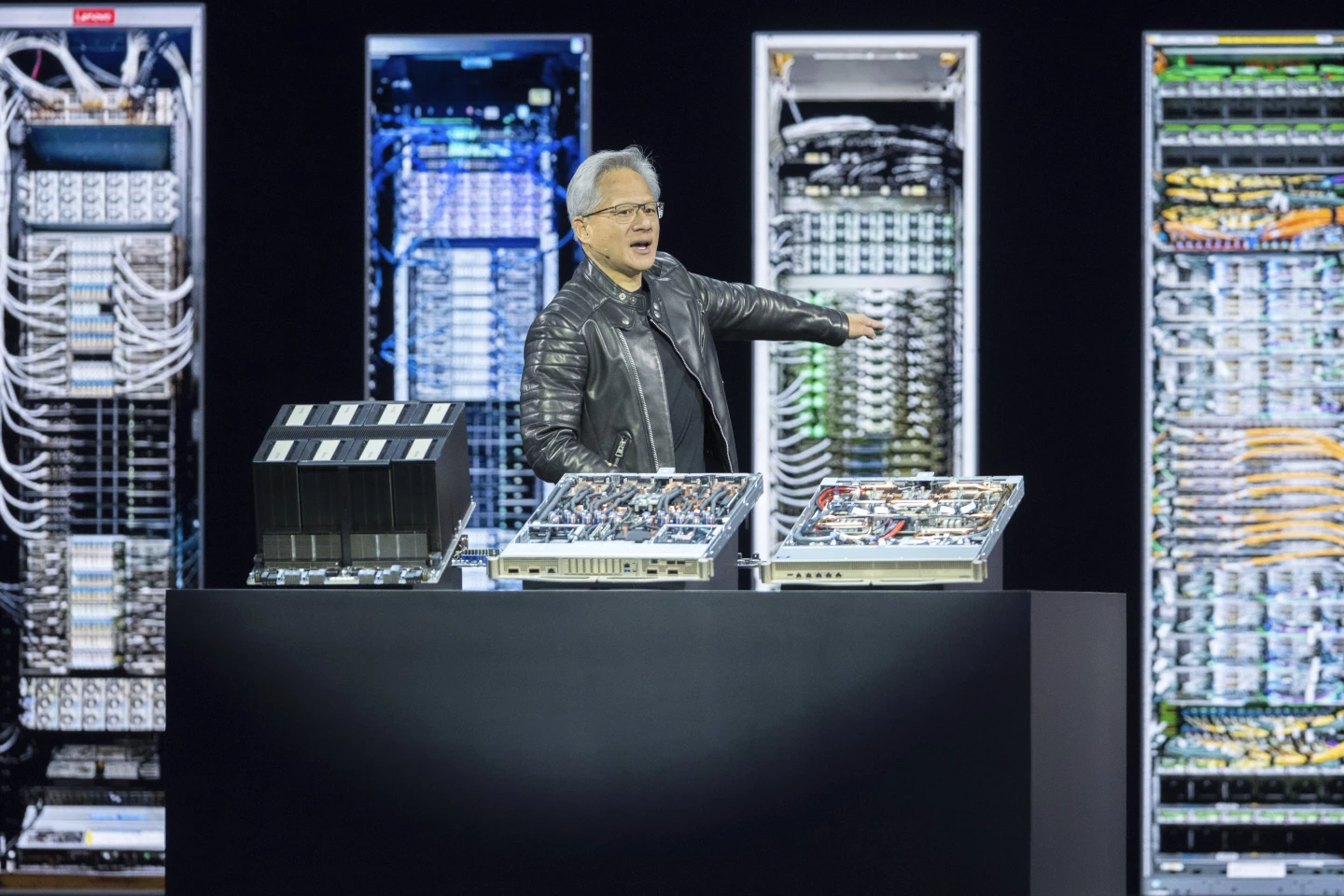

Nvidia still dominates the market in designing semiconductor technology that powers breakthrough AI applications like ChatGPT and self-driving vehicles.

Looking Ahead

While Nvidia’s shares have dropped about 25% since Election Day (compared to the S&P’s 8% decline), it’s worth remembering that the company was the S&P’s top performer in both 2023 and 2024.

The AI revolution continues to drive incredible demand for advanced chips, and Rosenblatt analysts believe Nvidia can “make up most of this revenue” hit through sales of its latest GPUs outside of China.

In the rapidly evolving landscape of global tech trade, even the mightiest companies must adapt to shifting political winds.

But if there’s one thing Nvidia has demonstrated, it’s resilience in the face of challenges – continuing to innovate and power the AI revolution that’s transforming industries across the globe.

Contact us today through our website or WhatsApp to discover how we can help you achieve success in the United States. Together, we can turn dreams into reality.

Information source: forbes.com